Investors are cheering SoundHound AI Inc. (NASDAQ: SOUN) this morning after the company’s impressive show of agentic artificial intelligence (AI) capabilities at the CES 2026.

At the annual trade show, the voice AI specialist announced a new partnership with “TomTom” as well, that made Oppenheimer analysts issue a positive note in its favour on Friday.

Despite these positive developments, SoundHound stock remains down about 40% versus its 52-week high.

SoundHound stock is the leading voice AI name

In their research note, Oppenheimer analysts dubbed SoundHound a “leader” in the voice AI space.

Importantly, the firm’s dominance is already being reflected in numbers.

SOUN has already more than doubled its revenue in the trailing 12 months – but analysts believe it’s poised to replicate that performance in 2026 as well.

In fact, SoundHound may be one of the fastest top-line growers in software this year, Oppenheimer told clients in its latest report.

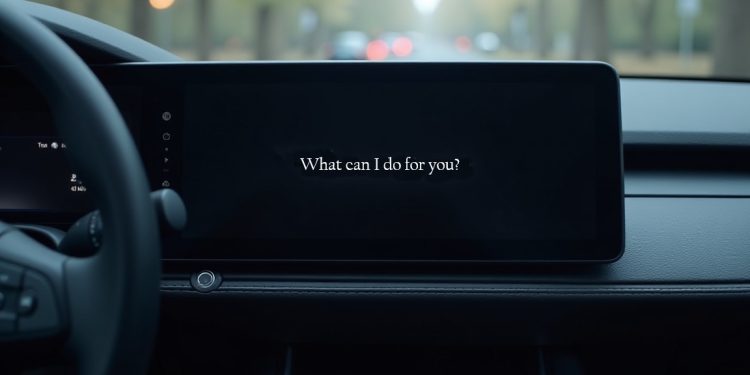

The investment firm’s bullish remarks arrive shortly after SOUN demonstrated new AI capabilities at the CES 2026, which enables vehicles to make reservations and perform other “complex tasks”, without human input.

SOUN stock is worth owning in 2026 also because the company has much more cash than debt – positioning it ideally for continued strategic investments.

How TomTom partnership helps SOUN shares

SoundHound’s new partnership with “TomTom” is a strategic win that notably bolsters its footprint in automotive and navigation technology.

By integrating its advanced voice AI with the Dutch multinational’s mapping and location services, SOUN is promising smarter in-car experiences: hands-free navigation, real-time traffic insights, and seamless voice-driven commands.

For investors, this signals a clear path to monetisation in a high-growth sector, which helps explain Oppenheimer’s constructive view on SoundHound shares.

“SOUN is a well-run business, strategically positioned to support voice AI monetisation initiatives across vertical and enterprise IT systems,” its analysts wrote.

Note that SoundHound AI Inc. does not currently pay a dividend, though.

SoundHound isn’t inexpensive to own in 2026

Despite aforementioned positives, however, Oppenheimer analysts “agreed” that SOUN shares are not inexpensive to own at a price-to-sales (P/S) multiple of nearly 30 currently.

That’s primarily why they maintained their “market-perform” rating on the voice AI firm today.

Still, valuation alone shouldn’t deter believers. High-growth software companies often command premium multiples – and SoundHound’s fast-growing revenue, strong balance sheet, and strategic partnerships suggest the company can justify its valuation.

For believers in the voice AI story, SOUN remains attractive as it continues to prove real-world monetisation opportunities across automotive and enterprise IT.

While near-term volatility is possible, the firm’s leadership position and cash-rich profile make it a compelling hold for those betting on artificial intelligence-driven disruption.

Investors could also take heart in the fact that the consensus rating on SoundHound also currently sits at “buy,” with the mean target of about $16 indicating potential upside of another 35% from here.

The post SoundHound may be ‘one of software’s fastest top-line growers’ in 2026 appeared first on Invezz