Nvidia made headlines on Tuesday after issuing an unusual seven-page memo to Wall Street analysts explicitly denying allegations of accounting fraud “akin to Enron.”

The response was triggered by viral claims from Michael Burry, the investor famous for predicting the 2008 financial crisis, and a Substack critique questioning whether AI capex sustainability masks hidden leverage.

The allegations don’t accuse Nvidia of outright financial misrepresentation, but rather question whether its complex web of strategic investments and depreciation assumptions artificially inflate business health in ways that could unwind catastrophically if AI demand disappoints.

Nvidia’s memo clarifies that its accounting is transparent and legal, but the underlying economic concerns persist unresolved.

The ‘circular financing’ problem: Why Burry’s Cisco comparison matters more than Enron

Here’s the critical distinction: Burry isn’t arguing that Nvidia is cooking the books like Enron did with special-purpose vehicles.

Instead, he’s drawing parallels to Cisco’s 1999-2000 collapse, when telecom companies massively overinvested in fiber infrastructure based on exponential demand projections that never materialized.

Nvidia’s memo counters that circular financing allegations are “unfounded,” stating only $4.7 billion in strategic investments year-to-date against massive revenues.

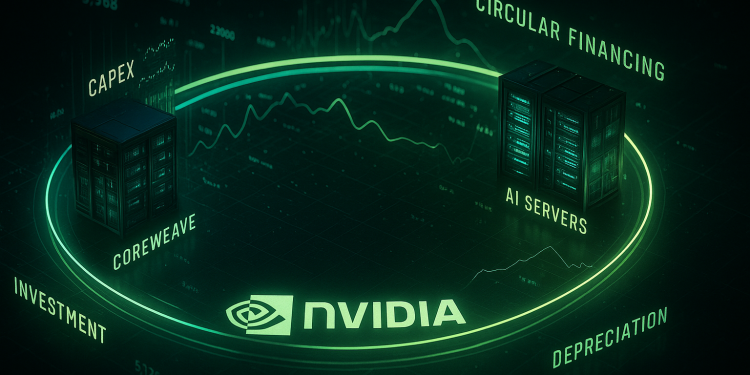

But the economic structure tells a different story. Nvidia invested heavily in CoreWeave, an AI cloud provider that buys Nvidia GPUs and resells capacity to customers, then guaranteed to purchase any unused capacity through 2032.

Separately, Nvidia is planning to invest in OpenAI, which now plans trillion-dollar data centers filled with Nvidia chips.

This isn’t technically fraud; it’s completely legal and fully disclosed.

But economically, it creates a problem: CoreWeave has $6 billion-plus in debt and operates at massive losses ($1.2 billion operating loss in early 2025), surviving primarily because Nvidia props up demand.

If CoreWeave fails, Nvidia loses both its equity investment and a major customer. Burry’s real argument is simpler: Nvidia’s business is artificially inflated by customers that only exist because Nvidia funded them.

That’s not Enron; it’s a circular economic loop dressed up as innovation.

The real risk: Depreciation assumptions and when ‘legal’ becomes dangerous

Burry’s most pointed criticism concerns GPU depreciation timelines. He claims hyperscalers are extending useful lives from 2–3 years to 5–6 years to reduce annual depreciation charges and artificially boost earnings.

Nvidia’s memo counters that GPUs maintain high utilization and value for 4–6+ years, citing the A100 model from 2020 still running strong in 2025.

Both sides have mathematically valid points, but the economic gap between them is massive.

If AI demand collapses 50% in 2026–2027, hyperscalers will write down equipment value fast.

Burry estimated the industry could be understating depreciation by $176 billion through 2028, potentially overstating profits by 20% or more at major data center operators.

Nvidia’s memo doesn’t resolve this risk; it just asserts accounting is clean. But cleanliness isn’t the issue; systemic risk is.

When leverage unwinds after excessive capex cycles, the market won’t care about the semantic difference between fraud and optimistic accounting assumptions.

The real question isn’t whether Nvidia is committing fraud today, it’s whether the entire AI infrastructure ecosystem is repeating the telecom playbook with better PR.

The post Nvidia Enron allegations explained: what Michael Burry, CoreWeave and the memo really mean appeared first on Invezz