Nvidia just delivered the earnings beat Wall Street needed to silence skeptics about the AI spending cycle.

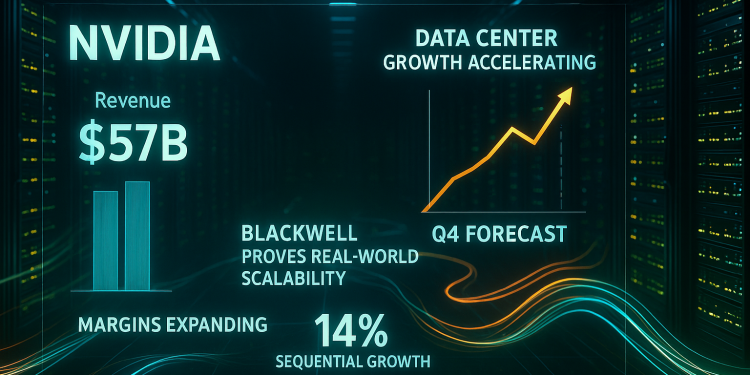

The company posted $57 billion in quarterly revenue, blowing past its own $54 billion guidance by $3 billion.

Nvidia reported a strong earnings per share (EPS) of $1.30 for Q3, beating analysts’ expectations of around $1.26 and reflecting robust profitability amid accelerating AI demand.

But here’s what really matters: management’s bullish $65 billion forecast for Q4 suggests the AI capex boom isn’t showing signs of stopping anytime soon.

At the time of writing this report, Nvidia’s stock is already soaring 4% in after-hours trading.

Blackwell finally proves it can scale

Let’s cut through the noise. Nvidia’s data center division, the real money-maker, pulled in $51.2 billion.

That’s a 25% jump from the previous quarter and 66% growth year-over-year. This is the Blackwell story everyone’s been waiting for.

Here’s why it matters. For months, investors worried the company’s next-gen AI chip would face production delays or customer hesitation.

Some analysts fretted that hyperscalers like Microsoft and Amazon might slow their spending or pivot to custom silicon. None of that happened.

The sequential acceleration from Q2 to Q3 proves Blackwell adoption is real, not just theoretical.

The margin story backs this up, too. Nvidia held gross margins steady at 73.6%, which matches guidance. More importantly, the company guided for 74.8% to 75% margins in Q4.

That’s margin expansion heading into the new year. When a company can simultaneously grow revenue 22% sequentially while expanding margins, it signals that pricing power remains intact. AMD and custom chips aren’t winning on price alone.

There’s something else worth noting. Data center revenue hit 90% of total company revenue. That’s concentration risk, sure. But it’s also proof that Nvidia’s fortress in AI chips remains unshaken.

Professional visualization, gaming, and automotive are still there, growing 26% to 56% year-over-year, but they’re sideshows compared to the main event.

The forward guidance that shifted everything

Now let’s talk about what really flipped sentiment. Nvidia’s $65 billion Q4 guidance is essentially saying:

The AI capex cycle is accelerating, not moderating.

That’s a 14% sequential increase from Q3. For a company already running a $225+ billion annual revenue rate, that growth rate is insane.

This matters because it directly addresses the bear case. Investors worried hyperscalers built too much capacity too quickly. They feared a capex pullback was inevitable.

Management just signaled that’s not happening. Q4 typically sees seasonal strength, but this guidance goes beyond typical patterns.

Free cash flow tells the same story. Nvidia generated $22.1 billion in the quarter, up 64% from Q2. The company’s balance sheet is a fortress. There’s no debt stress, no liquidity concerns, just rivers of cash flowing in.

The bottom line? This wasn’t just a beat. It was a confidence reset.

Nvidia proved Blackwell works at scale, defended margins against competition, and signaled the AI infrastructure build-out will continue through 2026. For investors, that’s exactly what they needed to hear.

The post Nvidia crushes Q3 earnings: $57B revenue, $65B Q4 guide signals AI supercycle appeared first on Invezz