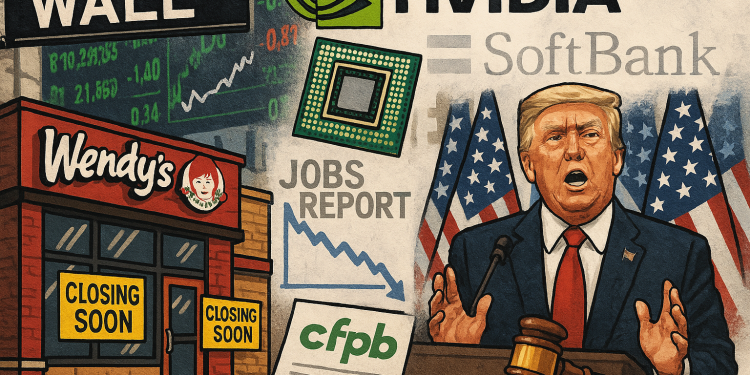

US markets saw various developments on Tuesday.

Nvidia shares slipped following news that SoftBank had sold its stake, while Wendy’s announced plans to shutter hundreds of restaurants as consumer spending weakens.

Fresh ADP data signaled cooling job creation, President Donald Trump celebrated progress on ending the government shutdown, and AMD projected major growth in AI infrastructure spending.

Nvidia shares dip after SoftBank sells entire $5.8B stake

Nvidia Corp. shares fell 2.5% to $194 on Tuesday after Japan’s SoftBank Group disclosed it had sold its entire stake in the chipmaker for $5.83 billion in October.

The sale, revealed in SoftBank’s fiscal second-quarter earnings report, came despite a 5.8% rise in Nvidia’s stock the previous day amid optimism over the end of the US government shutdown.

SoftBank’s report showed a surge in quarterly net profit, largely driven by gains from its investment in OpenAI.

While the Nvidia sale is small compared to the chipmaker’s $4.8 trillion market capitalization, it arrives ahead of Nvidia’s earnings on November 19 and amid debate about inflated valuations in the AI sector.

Analysts remain upbeat on Nvidia’s outlook. UBS’s Timothy Arcuri reiterated a Buy rating and a $235 price target, projecting earnings per share of $1.29 on revenue of $56.2 billion. He highlighted that investor focus will likely center on Nvidia’s ability to scale AI infrastructure and manage customer concentration risks.

SoftBank, meanwhile, is pivoting further into AI through OpenAI investments and its $500 billion “Stargate” infrastructure project, underscoring shifting dynamics in the AI ecosystem.

Wendy’s to close hundreds of US restaurants amid slowing sales

Wendy’s announced plans to close several hundred underperforming US locations starting in the fourth quarter, as inflation pressures lower-income consumers.

Interim CEO Ken Cook said the closures would affect a “mid-single-digit percentage” of the company’s 6,011 domestic restaurants, roughly 300 stores.

The company reported a 4% drop in US same-store sales and a 2% decline in revenue to $1.63 billion for the first nine months of the year.

Net income fell 6% to $138.6 million.

Cook noted that while value deals such as $5 and $8 meals have boosted traffic, Wendy’s has struggled to attract new customers.

The company plans to refocus marketing on freshness and value. Wendy’s shares rose 2.5% to $8.76 but remain down 46% for the year.

ADP data shows slowing job creation

Private-sector employment growth slowed in late October, according to data from ADP.

The US lost an average of 11,250 jobs per week in the four weeks ending October 25, signaling softening momentum in the labor market.

While ADP’s earlier monthly report showed a 42,000-job increase, the firm said recent gains were not broad-based, with declines in professional services, information, and leisure sectors.

Economists expect job growth to remain subdued as labor shortages and weak demand persist.

Trump praises congressional progress on ending shutdown

Former President Donald Trump applauded lawmakers for advancing a bill to end the government shutdown, congratulating House Speaker Mike Johnson and Senate Majority Leader John Thune during a Veterans Day speech in Arlington.

Trump called the agreement a “big victory” and urged unity to reopen the government, adding, “It should have never been closed.” Vice President JD Vance also praised the nation’s service members, calling them America’s “most valuable resource.”

Justice department declares CFPB funding illegal

The Trump administration’s Justice Department declared the Consumer Financial Protection Bureau’s (CFPB) current funding mechanism illegal, stating that the agency cannot draw funds from the Federal Reserve when it operates at a deficit.

As the Fed has been unprofitable since 2022, the CFPB could run out of funds by early 2026 unless Congress intervenes.

The ruling could force lawmakers to revisit the agency’s structure and funding.

AMD sees $1 Trillion data center market by 2030

AMD CEO Lisa Su projected that the global data center market could grow to $1 trillion by 2030, fueled by surging demand for AI computing infrastructure.

Speaking at the company’s Financial Analyst Day, Su said AMD expects 35% annual revenue growth over the next three to five years, with $45 billion in custom chip design revenue starting in 2026 and “tens of billions” in data center sales by 2027.

“There’s just insatiable demand,” Su said, pointing to AI infrastructure as a key long-term growth driver for the company.

The post US digest: Nvidia slips after SoftBank exit, Wendy’s to close stores, job growth slows appeared first on Invezz